When it comes to investing, making informed decisions is crucial for financial growth and stability. One such investment option that has gained attention is TRBCX, a prominent mutual fund known for its strong performance and strategic management. Understanding the intricacies of TRBCX can help investors make better choices for their portfolios, ensuring long-term financial success.

TRBCX, also known as the T. Rowe Price Blue Chip Growth Fund, has been a preferred choice for investors seeking exposure to high-quality, large-cap growth stocks. With a focus on companies that exhibit strong potential for long-term growth, the fund is managed by a team of skilled professionals dedicated to maximizing returns while minimizing risks. But what truly sets TRBCX apart in the competitive world of mutual funds?

In this comprehensive guide, we’ll delve deep into everything you need to know about TRBCX, from its performance history and investment strategy to its benefits and potential risks. Whether you’re a seasoned investor or someone just starting their financial journey, this article will provide valuable insights to help you determine if TRBCX is the right fit for your investment goals.

Table of Contents

- What Is TRBCX?

- Who Manages TRBCX?

- How Has TRBCX Performed Over the Years?

- What Are the Key Holdings in TRBCX?

- Why Invest in TRBCX?

- What Are the Risks Associated with TRBCX?

- How to Invest in TRBCX?

- TRBCX Expense Ratio and Fees

- How Does TRBCX Compare to Other Mutual Funds?

- Is TRBCX Suitable for Long-Term Investors?

- What Investment Strategies Are Used in TRBCX?

- How Diversified Is TRBCX?

- Can TRBCX Help You Achieve Your Financial Goals?

- What Are the Tax Implications of Investing in TRBCX?

- Tips for Investing in TRBCX

What Is TRBCX?

TRBCX, or the T. Rowe Price Blue Chip Growth Fund, is an equity mutual fund that primarily invests in large-cap growth companies. These companies are typically leaders in their respective industries, boasting strong market positions, competitive advantages, and a track record of consistent growth. The fund aims to provide long-term capital appreciation by focusing on high-quality growth stocks.

Who Manages TRBCX?

The TRBCX fund is managed by the experienced team at T. Rowe Price, a globally recognized investment management firm. The lead portfolio manager, currently Paul Greene, leverages a rigorous research-driven approach to select stocks with the best growth potential. With years of expertise and a solid understanding of market dynamics, the management team plays a pivotal role in the fund's success.

How Has TRBCX Performed Over the Years?

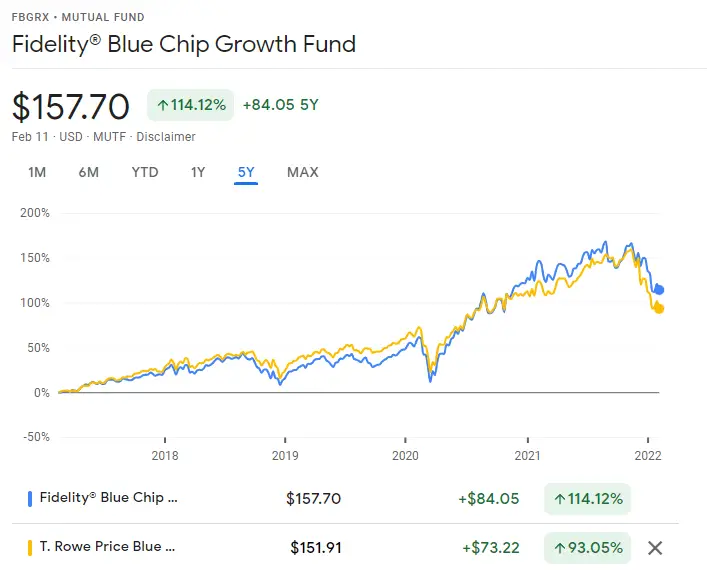

The performance of TRBCX has been noteworthy, consistently delivering strong returns compared to its benchmark indices. While past performance does not guarantee future results, TRBCX has demonstrated resilience and growth potential, even during volatile market conditions. Historical data reveals its ability to outperform many of its peers in the large-cap growth category.

What Are the Key Holdings in TRBCX?

TRBCX's portfolio includes some of the biggest names in technology, healthcare, and consumer discretionary sectors. Key holdings often feature companies like Apple, Amazon, Microsoft, and Alphabet. These industry giants are chosen for their innovative capabilities, strong balance sheets, and potential for sustained growth.

Why Invest in TRBCX?

Investing in TRBCX offers several advantages:

- Access to a well-diversified portfolio of high-quality growth stocks.

- Expert management by a reputable investment firm.

- Consistent performance history with competitive returns.

- Focus on long-term capital appreciation.

What Are the Risks Associated with TRBCX?

Like any investment, TRBCX comes with its own set of risks:

- Market Risk: The value of the fund's holdings can fluctuate based on market conditions.

- Sector Concentration: Heavy exposure to certain sectors may increase risk.

- Volatility: Growth stocks can be more volatile than value stocks.

How to Invest in TRBCX?

Investing in TRBCX is straightforward. You can purchase shares directly through T. Rowe Price or via brokerage platforms that offer mutual fund investments. It's important to review the fund's prospectus and consult with a financial advisor to ensure it aligns with your investment goals.

TRBCX Expense Ratio and Fees

TRBCX has a competitive expense ratio that reflects its active management and research-driven investment approach. While the fees may be slightly higher than passively managed funds, they are justified by the fund's consistent performance and potential for higher returns.

How Does TRBCX Compare to Other Mutual Funds?

When compared to other mutual funds in the large-cap growth category, TRBCX often stands out due to its strong track record, robust stock selection process, and experienced management team. Its focus on quality and growth makes it a compelling choice for investors seeking long-term capital appreciation.

Is TRBCX Suitable for Long-Term Investors?

TRBCX is an excellent option for long-term investors who are willing to tolerate short-term volatility for the potential of significant long-term gains. Its focus on high-quality growth stocks aligns well with the objectives of investors looking to build wealth over time.

What Investment Strategies Are Used in TRBCX?

The fund employs a growth-oriented investment strategy, emphasizing companies with strong earnings growth, innovative capabilities, and competitive advantages. The management team conducts in-depth research and analysis to identify stocks with the best growth potential.

How Diversified Is TRBCX?

While TRBCX primarily focuses on large-cap growth stocks, it maintains diversification across various sectors, such as technology, healthcare, and consumer discretionary. This diversification helps mitigate risks associated with sector concentration.

Can TRBCX Help You Achieve Your Financial Goals?

TRBCX can be a valuable component of an investment portfolio, especially for those aiming for long-term capital appreciation. By investing in high-quality growth stocks, the fund offers the potential for substantial returns, aligning with the financial goals of many investors.

What Are the Tax Implications of Investing in TRBCX?

Investors should be aware of the tax implications associated with TRBCX, including capital gains taxes on distributions and potential tax liabilities upon selling shares. Consulting with a tax professional can help you understand these implications and plan accordingly.

Tips for Investing in TRBCX

To maximize the benefits of investing in TRBCX, consider the following tips:

- Assess your risk tolerance and investment goals before investing.

- Monitor the fund's performance and review its holdings regularly.

- Diversify your portfolio to reduce risk.

- Consult with a financial advisor for personalized investment advice.

Detail Author:

- Name : Emmalee Walker

- Email : leonie06@gmail.com

- Birthdate : 1987-05-08

- Address : 710 Hirthe Point Suite 533 Beulahchester, AZ 03132

- Phone : 985.421.1433

- Company : Ward-White

- Job : Pipefitter

- Bio : Modi facilis velit suscipit dolorem dolores nisi et. Autem aut eos qui quibusdam. Dolorum nihil molestiae natus aut et voluptatibus vel. Eos quo eveniet ut eum doloremque praesentium.